BOOK PRINTING FACTORY

Custom Book Printing

Since 1992

Custom Book Printing

Since 1992

Product details

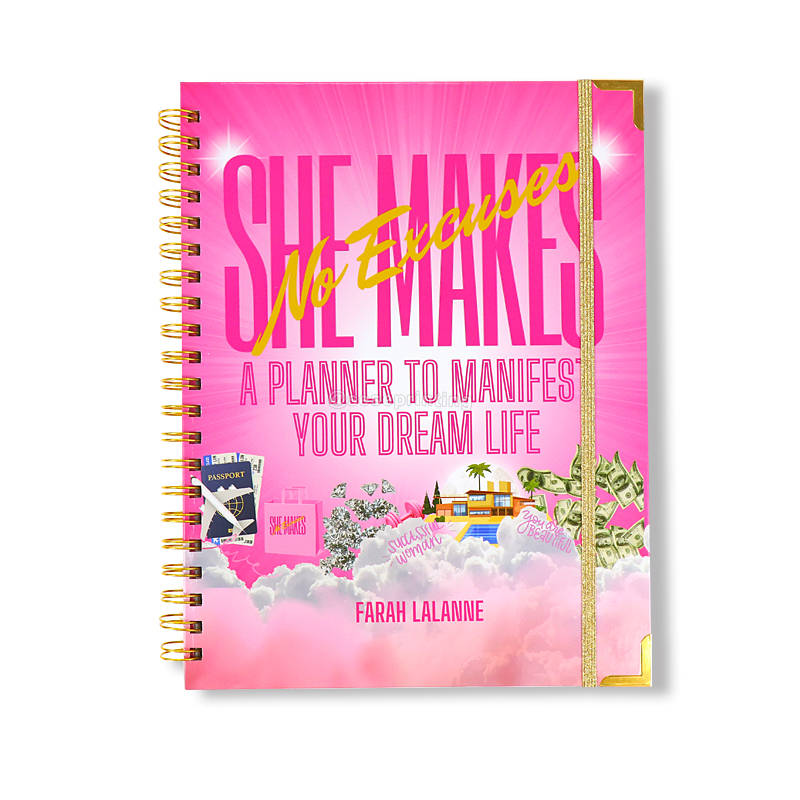

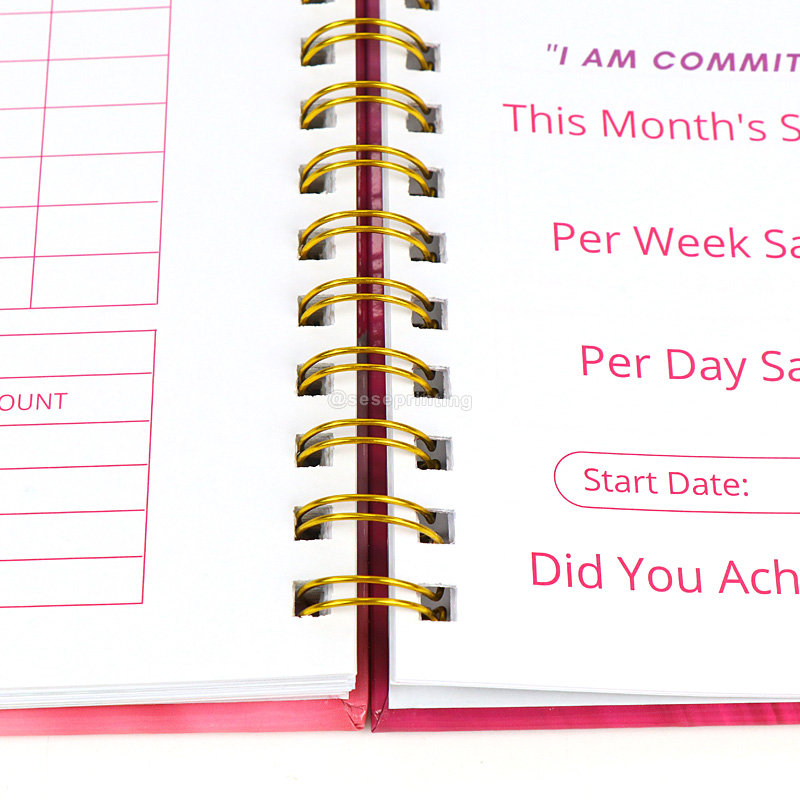

| Product Name | Budget Planner |

| Material | Art Paper, Kraft Paper,Coated Paper, White or Grey Paper, Silver or Gold Card Paper, Special Paper Etc. |

| Binding | Wire-O Binding, Spiral Binding, Hardcover Binding, Perfect Binding, Disc Bound Binding, Binder Binding and Others. |

| Certification | ISO9001, SA8000, FSC |

| Design | From Clients,OEM |

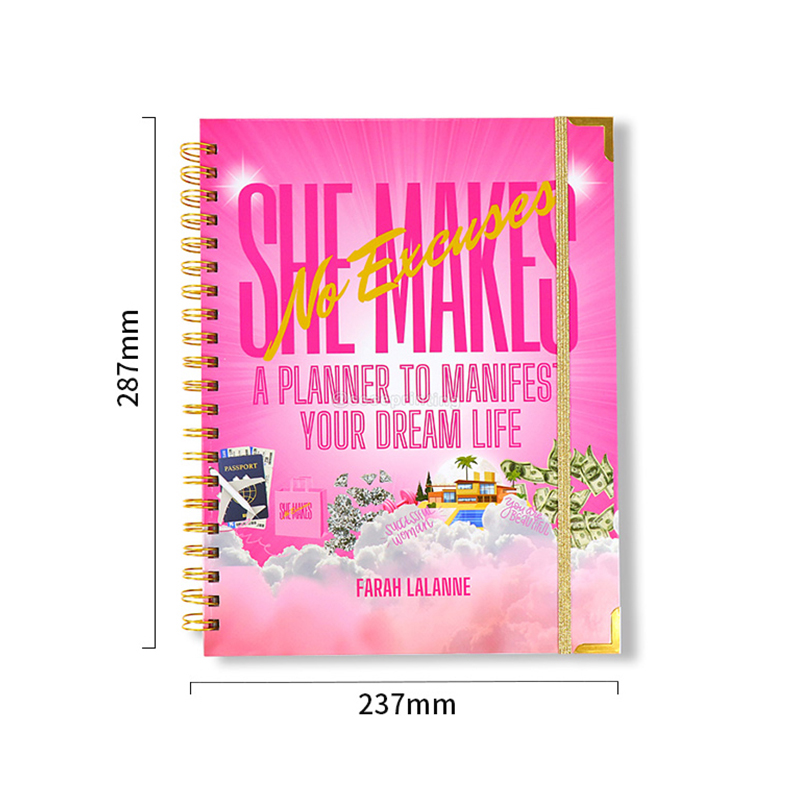

| Size | A4, A5 or Custom |

| Printing | CMYK or Pantone |

| Artwork Format | AI, PDF, ID, PS, CDR |

| Finishing | Gloss or Matt Lamination, Gold Foil Stamping, Emboss, Deboss and More |

|

|

|

Planner Size |

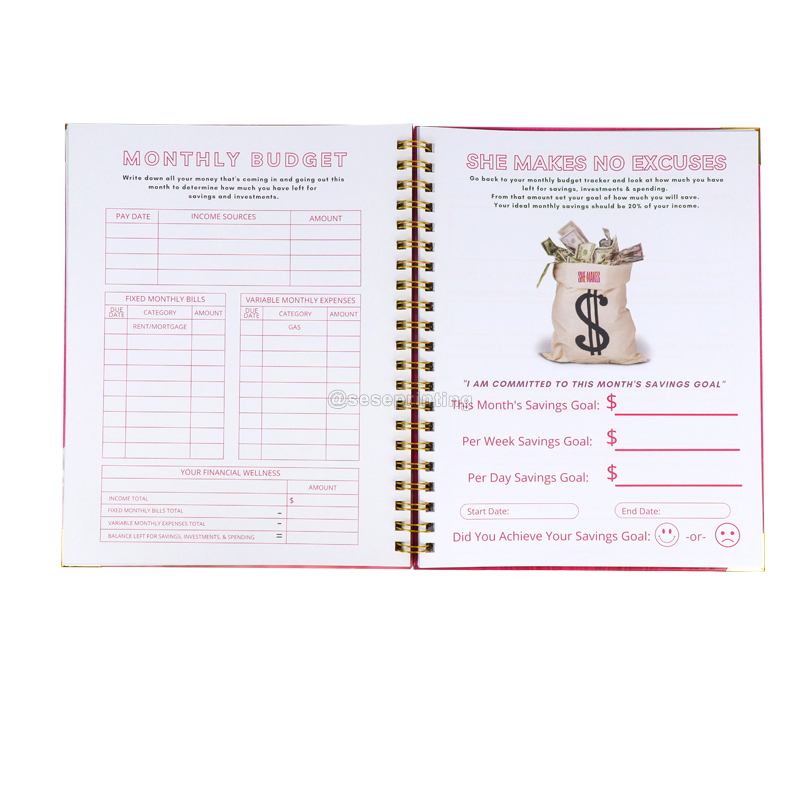

Custom Your Own Page Design |

|

|

|

|

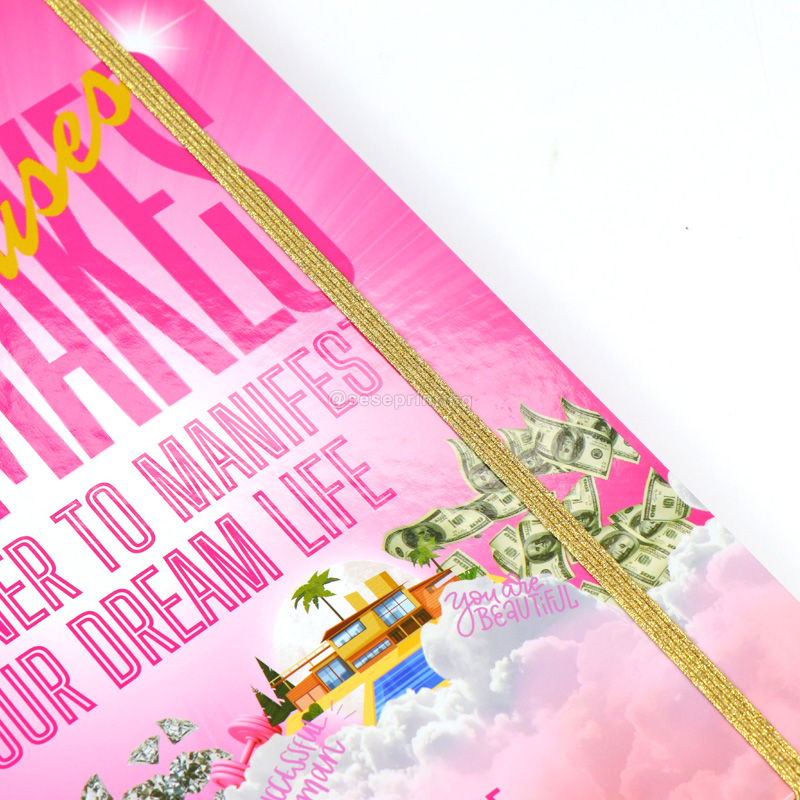

Elastic Band |

Metal Corner |

Wire-o Binding |

Related Suggestion

Related Suggestion

Tel

Tel

Email

Email

Address

Address

301, NO.233 PingKang Road, Shiqiao St.,Panyu District, Guangzhou City, Guangdong Province, China 511400

Whatsapp

Whatsapp

Home

Home